San Francisco Luxury House Sales Hit New High

The Hottest Real Estate Markets in San Francisco

12-Year Trends in Neighborhood Home Prices

Advantages to Buying during the Holiday Slowdown

————————————————————

The October 2017 median house sales price in San Francisco surged over $100,000 above the previous peak in May to hit a new high at $1,588,000 (sales reported by 11/5/17). A major factor was that October was a record-breaking month for luxury house sales, and more sales of expensive homes pull up the median price. The median condo sales price, at $1,180,000, was a tad below the recent peak hit in August, and luxury condo sales reported to MLS were well below their peak sales volume reached this past June. The luxury market is covered further down in this report.

We prefer measuring median price trends by periods longer than 1 month (which are prone to fluctuate considerably without great meaningfulness), and the below chart illustrates rolling 3-month median price trends for houses ($1,415,000 for August, September, October) and condos ($1,175,000), and 6-month rolling median prices for TICs ($982,500). Remember that median price changes are not perfect measurements of changes in fair market value.

And this chart below based on CoreLogic S&P Case-Shiller data compares the appreciation of the more expensive Bay Area home markets (blue line) – such as most of SF, Marin, San Mateo and Diablo Valley – to the overall national trend (green line), going back to 1987. It is interesting to see where our local appreciation rates have diverged from national rates: The divergence since 2012 has been particularly striking.

Note that the numbers on this chart all refer to a January 2000 price of 100. So, the latest Bay Area reading of 238 means that home prices here have appreciated, according to Case-Shiller, by 138% since January 2000. National home prices appreciated by 95% during that period.

————————————————————

San Francisco Neighborhood & Realtor District Map

San Francisco Market Overviews

SF House, Condo & TIC Sales by Realtor District

Some districts are dominated by house sales and others by condo sales. The most balanced is the greater Noe, Eureka & Cole Valleys district with almost equal numbers of both. Condo sales now outnumber house sales in the city, a trend which will continue to accelerate with new construction. Looking at the horizontal columns below, the gray portion represents house sales, the teal, condo sales, and the green, TIC sales.

SF Home Sales by Price Segment

Home sales under $1m are dwindling, and 70% of those are condos or TICs.

The highest number of sales is now in the $1m to $1.5m price segment.

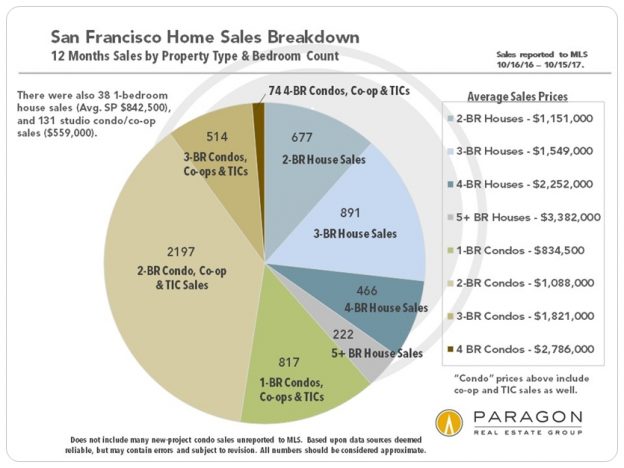

Sales by Property Type & Bedroom Count

Compared to other Bay Area markets, SF has more small, 2-bedroom houses and fewer

big, 5+ BR, house sales – and far more condo sales at much higher prices than in other counties. By far the most prevalent SF home sale now is a 2-bedroom condo.

Link to Chart: New Listings Trends since 2007

Link to Chart: Unit Sales Trends since 2007

————————————————————

San Francisco Luxury Homes Market

As mentioned before, luxury house sales hit a new high in October 2017: In recent years, October has become the biggest month for very expensive house sales. This is not the case for luxury condos, which typically peak in spring. Looking at broader trends in the second chart below, the luxury home market grew dramatically from 2012 through 2015, cooled significantly in 2016 (especially the luxury condo segment), and then surged back in 2017 to hit new highs. But then everything seems to be surging higher nowadays, from stock markets to homes to iPhone prices.

Luxury house sales in October were concentrated, highest to lowest numbers, in the Pacific Heights-Marina district (D7), the Noe, Eureka & Cole Valleys district (D5), and the Lake Street-Sea Cliff district (D1). These 3 districts contained about 80% of the sales. Other luxury house sales were scattered singly around the city: Russian Hill, Telegraph Hill, Inner Sunset, Potrero Hill, Mission, Bernal Heights, Hayes Valley and Lower Pacific Heights. The 3 districts that dominated luxury condo sales, with 9 to 11 sales each, were the Russian & Nob Hills district (D8), Pacific Heights-Marina (D7), and the South Beach-Mission district (D9). There were also a handful of sales in Noe-Eureka Valley (D5), and a couple in Lake Street-Richmond (D1). (Sales reported by 11/5/17.)

Link to Chart: Luxury Condo Sales by Month

————————————————————

Median Home Price Trends by Neighborhood

2005 to Present

Following are 2 charts on houses and one on condos illustrating home price appreciation trends over the past 12 years in selected neighborhoods. We generally picked neighborhoods with greater quantities of sales, but please contact us if you would like information on one not included below. (The highest priced house neighborhoods like Pacific and Presidio Heights – with median prices in the $6m range – have relatively few sales and an enormous range in sales prices, which has a tendency to make the trend lines jump up and down somewhat erratically.)

Neighborhoods with current median house prices under $1.5m have generally

seen smooth, consistent appreciation since the recovery began in 2012.

Neighborhoods with current median house prices of $1.5m to $3m:

Some of these saw median price dips in 2016, but recovered in 2017

Two-Bedroom Condos – Median Sales Price Trends:

Some SF condo markets saw significant dips in 2016, but recovered in 2017

On the chart below, South Beach would ideally be divided into two distinct neighborhoods, with condos on lower floors of highrises in one, and condos on higher floors in another (distinctly more expensive). Since that is not easily possible, the median price below is a blend of both. To a large degree, all median sales prices are derived from a blend of a wide range of individual sales, but the highrise dynamic is concentrated in the greater South Beach area.

————————————————————

SF Neighborhoods & Property Types: Hottest to Coolest Markets

The following charts looks at the various districts of the city by a number of standard statistical measures of supply and demand, or market heat. As has been the case for the last couple years, generally speaking, the greatest pressure of buyer demand has continued to be focused on the more affordable house neighborhoods (affordable by SF standards), such as those in the Sunset/Parkside District.

Note: These are general statistics and small differences between districts or market segments are not particularly significant.

Overbidding Asking Prices

First houses and then condos: The higher the %, the hotter the market.

Some of these percentages are staggeringly high.

Overbidding in the condo market is not quite as frantic as with houses.

Months Supply of Inventory & Average Days on Market

First houses, then condos: The lower the statistics, the hotter the market.

————————————————————

Hottest to Coolest by Price Segment & Property Type

To a large degree, what is seen below dovetails with the analysis by district above: More affordable home segments are strongest, and the affordable house segment in particular has been crazy feverish. The ultra-luxury condo market is, by far, the softest: Part of this is certainly due to competition from new, luxury condo projects coming on market.

————————————————————

Seasonality & the SF Homes Market

Advantages to buying during the mid-November to mid-January slowdown

Just before Thanksgiving the market begins to rapidly subside until starting to revive about 7-8 weeks later. Many buyers simply check out during this period, but there are good reasons for staying engaged – mainly the possibility of getting a much better deal. Starting in October and extending into November, sellers begin reducing prices in large numbers as they try to capture the attention of disappearing buyers: Buyers should treat these as brand new listings and take a new look. Competition between buyers drops dramatically during the mid-winter period, and since competitive bidding is the biggest single factor behind higher prices, its decline can mean significant savings. Fewer buyers also means that sellers are often more willing to negotiate: Throw offers in at whatever price you feel is right and see where they go. It is true that the number of new listings coming on markets plunges, but there are still hundreds of listings to consider for those willing to stay in the game.

The dark red lines in the charts below illustrate these big, seasonal market shifts.

Price Reductions Soar in October/November

Overbidding Declines

Average Days on Market Increases

Making sellers more willing to negotiate

Inventory Drops

But hundreds of listings remain on market

Median Home Prices Drop

due to a number of factors, including a reduction in demand

All our real estate analyses can be found here: Paragon Market Reports

Link to SF Neighborhood Home Price Tables

Link to our SF luxury house market update

Link to our SF luxury condo market update

Link to our apartment building market report

Please let us know if you have questions or we can be of assistance in any other way. Information on neighborhoods not included in this report is readily available.

————————————————————

These analyses were made in good faith with data from sources deemed reliable, but may contain errors and are subject to revision. It is not our intent to convince you of a particular position, but to attempt to provide straightforward data and analysis, so you can make your own informed decisions. Median and average statistics are enormous generalities: There are hundreds of different markets in San Francisco and the Bay Area, each with its own unique dynamics. Median prices and average dollar per square foot values can be and often are affected by other factors besides changes in fair market value. Longer term trends are much more meaningful than short-term. Late-reported MLS activity may change the statistics for the last month in some charts.

© 2017 Paragon Real Estate Group

| Paragon Real Estate Group www.paragon-re.com/ |

|

|