The San Francisco Luxury Home Market

Homes of $2 Million & Above

Auto-Updating Market Analytics

The bar charts compare year-over-year data, going back 2 years, for the latest month. The line charts track monthly data over a period of 3 to 5 years. Note that it can take 7 to 15 days after a month’s end for agents to enter in transaction data pertinent to the month in question, so statistics for the latest month can sometimes change significantly as this data is added to calculations.

Auto-Updating Market Analytics

Seasonality plays a significant role in luxury real estate statistics as the market ebbs and flows during active and less active sales seasons. Typically, the market is most active in the spring and fall, and much slower in the summer and, especially, the mid-winter holidays.

Moving your cursor over the line charts will reveal monthly data.

New Listings Coming on Market, by Month

September is usually the single biggest month for new high-end home listings.

Spring is typically the most active season for new listings.

New listing activity plunges during the mid-summer and mid-winter holidays.

Total Number of Active Listings for Sale during Month

Number of Listings Accepting Offers, by Month

Number of Sales, by Month

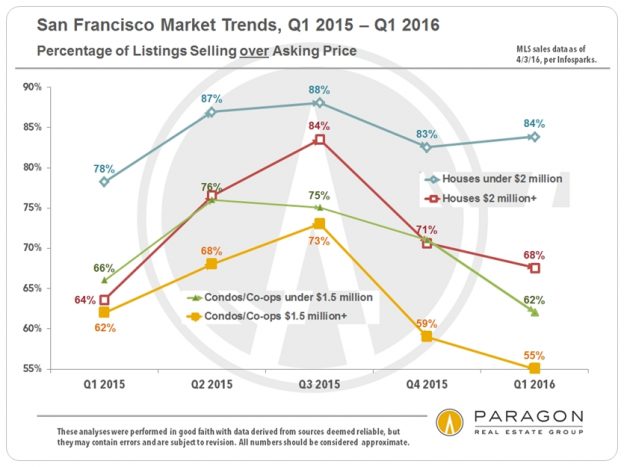

Percentage of Listings Selling for over Asking Price, by Month

Median Percentage of List Price Achieved on Sale

Over 100% usually signifies competitive overbidding;

under 100% signifies more aggressive buyer negotiation.

Median Dollar per Square Foot (upon Sale)

3-Month Rolling Average

Months Supply of Inventory (MSI), by Month

The lower the MSI, the greater the buyer demand as compared

to the inventory of listings available to buy.

Median Days on Market before Acceptance of Offer

3-Month Rolling Average

Expensive Home Sales by San Francisco District & Neighborhood

Note that these charts using differing price points for the “luxury home” designation.

Other reports you might find interesting:

Market Analytics for General SF Market

30+ Years of San Francisco Real Estate Cycles

San Francisco Neighborhood Affordability

10 Big Factors behind the San Francisco Real Estate Market

Bay Area Apartment Building Market

Link to San Francisco Neighborhood Map

It is the relationship between supply and demand that defines the state of the market. Looking at one statistic such as the number of sales, without comparing it to how many listings were available to purchase, may give a distorted view of market conditions. Some statistics, such as months supply of inventory take both supply and demand into account. Last but not least, short-term statistics sometimes fluctuate without great meaningfulness - longer-term trends are always most meaningful.

Sales data usually reflects market activity, i.e. when a new listing comes on market and offers are negotiated, occurring 4 to 8 weeks before the sale date. Thus, for example, sales in June mostly reflect new listings and offers negotiated in late April and May.