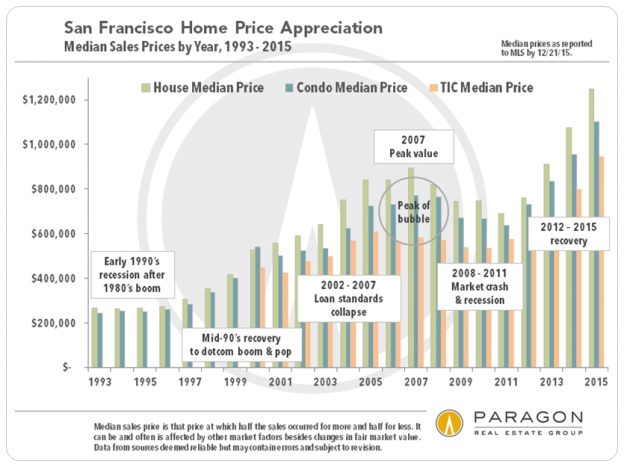

San Francisco Home Price Appreciation

|

||||||||||||||

|

||||||||||||||

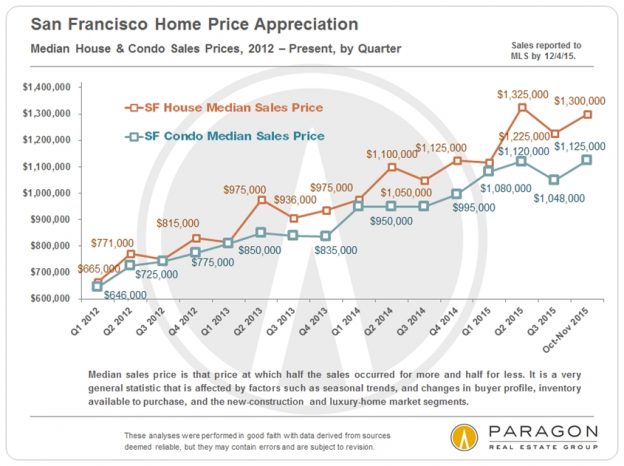

San Francisco Home Price Appreciation

|

||||||||||||||

|

||||||||||||||

It’s a very understandable question to ask. Does it really make a difference to buyers if a perfectly nice property is furnished? There is an old adage: “Buyers know what they see, not the way it’s going to be.” If this is true then staging is recommended.

The idea behind furnishing for marketing purposes is that the furnishings are intended to evoke an emotional response to the property from both buyers and Realtors. I want to believe that I, a professional who has seen thousands of homes in all kinds of conditions, can appreciate a space and its full potential when it’s clean, freshly painted, and with nice flooring. But even I react emotionally to a nicely furnished ‘home’ (staged) compared to a vacant ‘unit’ (unstaged).

My current listing at 500 Masonic #2 allowed me to compare both conditions: staged and unstaged. The unit itself has all the bells and whistles like 2 car parking, a view roof deck, a well laid out, spacious floor plan. It was recently painted, new lighting fixtures installed, new flooring installed, and cleaned from top to bottom. If any property can look good unstaged, it’s this one. And it does. It looks great unfurnished!

The sellers and I then had to decide whether to stage or not. We reviewed the pros and cons:

Staging takes time and money. Will the furniture make the space look smaller? Is it necessary to spend thousands of dollars to furnish when it looks perfectly fine in its current condition? etc.

We decided to stage. I would like to share with you the before and afters for the living room, master bedroom, and dining area. Which do you think looks better? If you have an opinion I’d love to hear it. Please email me at [email protected]

January 2016, Paragon Commercial Brokerage

Some charts below apply specifically to smaller, 2-4 unit buildings, others to larger, 5+ unit properties, and some to both. Each segment has distinct market dynamics. The first 2 charts illustrate the year over year decline in sales volume, but the continuing increase in values.

As seen above, 2015 saw a small drop in the sales of smaller, 2-4 unit apartment buildings in San Francisco, similar to that seen in the homes market. (It is not unusual for these buildings to have an owner occupier and/or be sold to buyers planning to occupy). There was a much bigger decline in the sales of larger, 5+ unit, investment properties: The latter drop reflected more a decline in portfolio sales (one owner, sometimes a financial institution, selling multiple properties) and an increased reluctance of owners to sell, than, so far, any substantial decline in buyer demand. Indeed, multiple offers on attractive listings remained common, the average sales price for 5+ unit buildings was almost 4% above asking price (7% for 2-4 unit buildings), and values continued to rise in 2015.

With low interest rates and soaring rents, many SF apartment buildings have become cash-generating machines, and prospective sellers would be challenged to find comparable returns in other investments. This reduces the motivation to sell and cash out. Furthermore, owners who might typically sell in order to buy larger buildings for better economies of scale via a 1031 exchange are daunted themselves by the difficulty of finding suitable upleg properties within the tight time constraints of tax law.

The first 4 to 6 weeks of the year are a slow period in real estate and the next tangible indication of market direction will come after the market begins to wake up in late-winter/ early spring.

--------------------------------------------------------------------

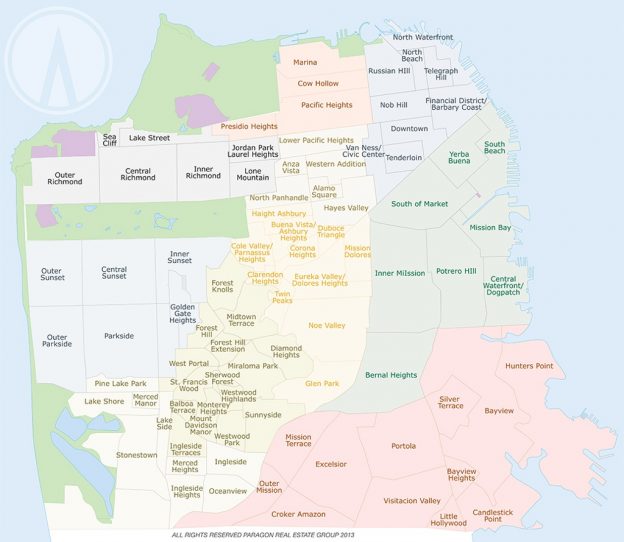

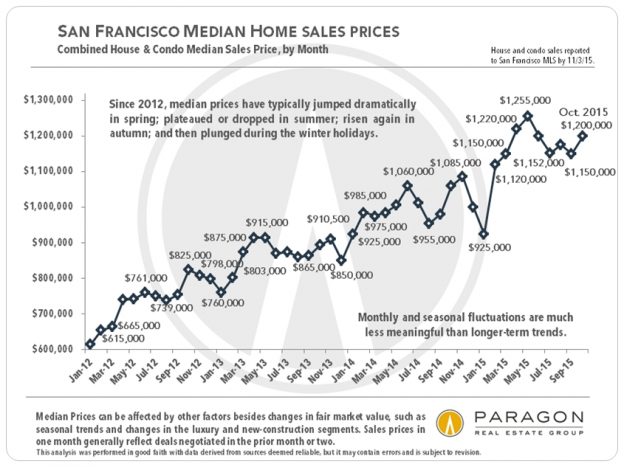

Prices, Values & Appreciation Trends

By San Francisco Neighborhood and District

--------------------------------------------------------------------

Supply & Demand

--------------------------------------------------------------------

Residential Rent Trends & Comparisons

In the first chart below, note that San Francisco rents fell far more after the dotcom bubble popped in 2001, and the resulting loss of thousands of high-tech jobs (see employment graph further below), than after the much larger, financial-markets crash of 2008. There is much vehement disagreement right now as to whether there are or are not meaningful parallels between the current high-tech boom and the earlier dotcom boom.

--------------------------------------------------------------------

San Francisco Employment

--------------------------------------------------------------------

Interest Rate Trends

Q4 2015 Sales of 5+ Unit Apartment Buildings

Please contact me if you would like further details on any of the sales listed,

or on properties currently available to purchase.

--------------------------------------------------------------------

Apartment Building Sales by Broker

All information is from sources deemed reliable, but may contain errors, is not warranted and subject to revision. Statistics are generalities that typically disguise an immense variety of specifics in the individual, underlying sales. Numbers should be considered estimates and approximations, and how these statistics apply to any particular property is unknown without a specific comparative market analysis.

Happy New Year!

Our amazing analyst at Paragon has put together over 20 charts in order to provide an understanding of the SF Market from multiple perspectives. Unless you are really into charts, it’s a lot of information. Some of the conclusions to be drawn include:

Although I don’t have a chart to illustrate it, I have had several clients thank me in the past few months for helping them buy their property 10, 15, and sometimes 20 years ago. They tell me it was the best investment they ever made–either because they can stay in their home into retirement (and in San Francisco), or because they can sell and use the equity built up over the years for their next chapter. I thank them profusely for sharing their feelings with me. It is stories like these that give my job meaning and make me feel like I am helping people, which is hugely important to me. Thank you!

|

||||||||||||||

|

||||||||||||||

Median Home Prices, Reflecting MLS Sales Reported 4/1/15 – 12/7/15

|

||||||||||||||

|

||||||||||||||

|

||||||||||||||

|

||||||||||||||

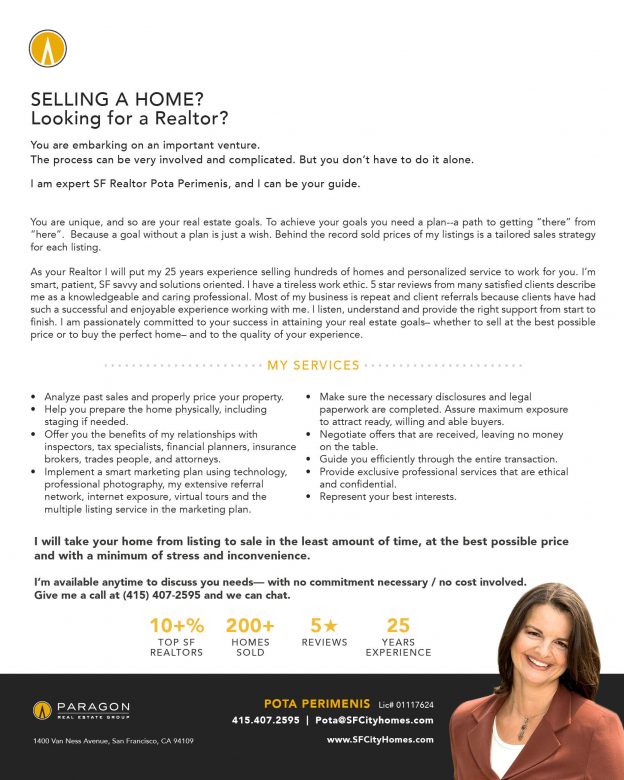

In one of the largest, most complicated financial transactions of your life, what exactly does an excellent real estate agent do to help you sell your home?

An excellent agent listing agent…

And these are the qualities and services that I try to deliver for every one of my clients. Because the quality of the agent working on your behalf—his or her competence, integrity, work ethic and commitment to your interests—can make an enormous difference in the outcome of your home sale: in money, stress, time and future happiness.

The simple truth is that, just as with lawyers, doctors, contractors and the other important professionals you use when needed, some real estate agents are much better than others—and that shows up in the end results.

Pota Perimenis is committed to providing an accessible website. If you have difficulty accessing content, have difficulty viewing a file on the website, or notice any accessibility problems, please contact us at (415) 407-2595 to specify the nature of the accessibility issue and any assistive technology you use. We strive to provide the content you need in the format you require.