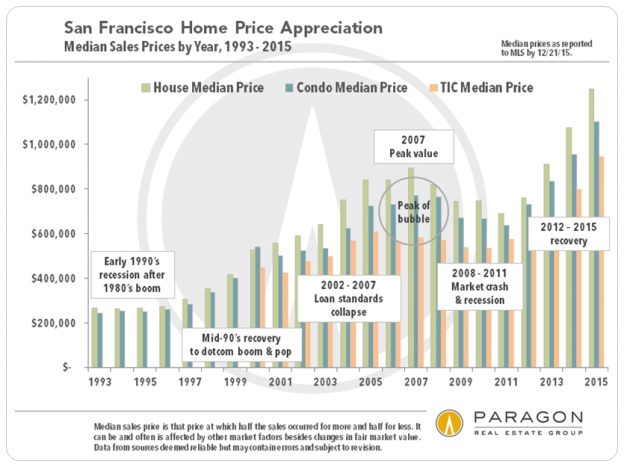

Architecture, views, probates, penthouses, lofts, TICs, luxury homes, mortgage rates, sales prices, market cycles, and everything else we could think of in a look back on 2015.

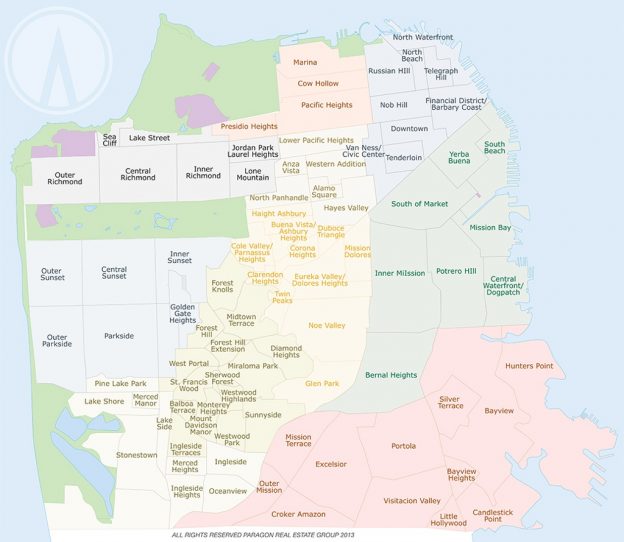

A neighborhood map of San Francisco is included at the bottom of this report for your convenience.

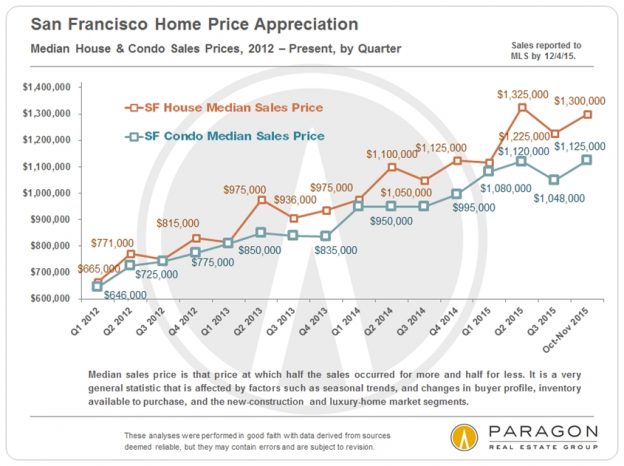

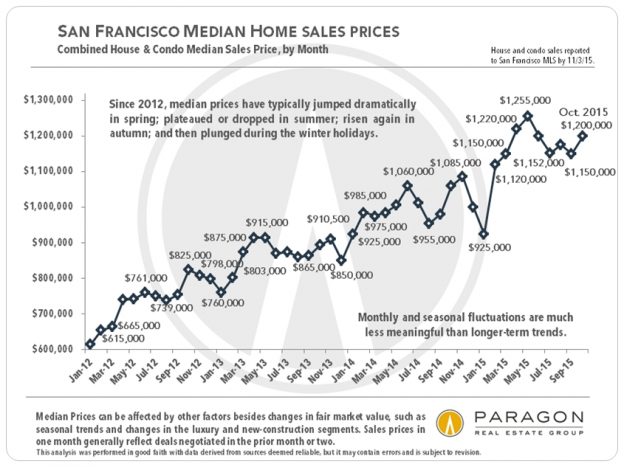

Quarterly Median Price Chart & Monthly Case-Shiller Chart

Despite anxiety about interest rates, financial markets, housing affordability, unending international crises, and possibly over-valued high-tech unicorns, the Q4 2015 San Francisco median house sales price, at $1,250,000, is up about 11% from Q4 2014. That dovetails nicely with the S&P Case-Shiller Home Price Index for the Bay Area, which measures appreciation in a different way, but also calculated 11% annual appreciation (through October, its last report). The Q4 condo median price, at $1,125,000, is up 13% year over year, but that is influenced by the greater percentage of more recently built, and more expensive, units in the sales mix.

We have also updated our popular price maps of San Francisco neighborhoods and the greater Bay Area: Home Price Maps

——————————————————————–

San Francisco has seen 3 extended periods of home construction: The first ran from the Gold Rush to the 1906 earthquake, when 28,000 buildings were destroyed. The second went from the post-quake rebuilding, with the construction of thousands of Edwardian houses and multi-unit buildings, through the big WWII population surge. Many districts such as the Marina and Sunset/Parkside were built out in the period from 1920 to 1950, with Spanish Mediterranean (in many variations), Marina-style and Art Deco being common architectural styles.

The city population then went into major decline during the subsequent 3 decades and construction plunged. The third era of homebuilding is all about new condo construction, which began around 1980, ebbed and flowed dramatically with the economy, and is currently booming once again.

——————————————————————–

A look at a few of the distinctive niches of the market.

——————————————————————–

San Francisco is famously a city of gorgeous views. For the simple reason of verticality, more condos have views and, generally speaking, more panoramic and spectacular views, than houses. Of course, many other lovely views add to SF home value as well: sweeping city views; park views; marina views; views of Alcatraz, Marin and Mt. Tamalpais; and of the East Bay and Mt. Diablo. A few lucky (typically, very affluent) condo owners have sensational views from the windows on all 4 sides of their high altitude units.

——————————————————————–

After being bludgeoned in 2015 by thousands of articles, predictions and warnings regarding interest rates, here is a look at how much they actually changed over the course of the year: Approximately one seventh of one percent. Per recent signals from the Fed, presumably mortgage rates will rise in 2016, but expectations over the last 6 years have been confounded far too often to be sure. Significant increases would certainly worsen the affordability equation for homebuyers financing their purchases.

——————————————————————–

Seasonality: Waiting for Spring

The 2 charts above illustrate the extreme seasonality of the market, both in the numbers of new listings coming on market, and the percentage of listings that accept offers (a measurement of supply vs. demand). The second chart also shows that the market for homes under $2 million has been hotter than the luxury home market: There are fewer buyers at the very high end, and luxury homes are also most prone to significant overpricing.

The spring selling season, which actually started in February last year, is typically the most feverish, and this is especially true for luxury homes: Notice, in the 2nd chart, the huge spike in demand for luxury homes last spring.

——————————————————————–

Average Dollar per Square Foot Values

——————————————————————–

Luxury home sales hit new peaks in spring 2015, but with the stock market volatility in late August and September, the market softened, inventory grew (to its highest point ever) and sales dropped by about 17% in October, year over year. (Affluent buyers and sellers are most influenced by financial market volatility.) However, the stock market then recovered and stabilized in October and buyer confidence improved, which is reflected in the year over year increase in sales that occurred in November and December.

Remember that sales in one month generally reflect the state of the market 3 to 6 weeks earlier, when the sale terms were negotiated: Stock market angst in September meant a weaker luxury home market in October; the stock market recovery in October brought about a stronger real estate market in November and December. Q4 2015 sales ultimately ended slightly up from Q4 2014.

Charts: Luxury House Sales by District & Luxury Condo Sales by District

——————————————————————–

Details, Amenities & Size

The above details are as described in MLS by listing agents, so the numbers are very approximate. Also note that what most people might see as a unit above a laundromat, an enthusiastic listing agent might see as a rarely available luxury penthouse.

One of the reasons the Pacific Heights district has by far the highest house prices in the city is that its average house size is so much larger. However, its mansions also command a very high dollar per square foot value, as seen in one of the earlier charts.

——————————————————————–

The sales of condo shall continue to make up a larger and larger share of overall home sales in San Francisco, as new condo construction continues apace. (Condos also turn over more often than houses.) Very few new houses are built in the city and they are usually big, high-tech, beautiful and costly.

——————————————————————–

Where the Most Home Sales Occur

——————————————————————–

San Francisco is very much a boutique market for multi-unit buildings: Our apartment buildings are generally much smaller, older and, for that matter, more gracious than those found in the suburbs. These properties are often at the heart of fierce controversies pertaining to rent control, tenants’ rights, tenant evictions, and condo conversion rules. There has been an immense increase in market rate rents over recent years (SF is the most expensive rental market in the country), though rules restrict increases for existing tenants of buildings built before 1979 (i.e. almost all of our apartment buildings).

The tenancy-in-common unit with an exclusive right to occupy, aka the TIC, is a property type rarely found outside of San Francisco. It was originally created as a way for sellers of multi-unit properties to get significantly more money: The individual unit sales adding up to more than the purchase of the entire building by one buyer. However, they also provided a lower cost alternative for homebuyers, since TICs typically cost 10% to 15% less than comparable condos. (The TIC phenomenon also generated significant legal fees for the lawyers who came up with the idea.) Because of changes in tenant eviction law and condo conversion rules, financing and other issues, the number of TIC sales has plunged since its peak in 2007. On the other hand, some TIC units are now selling for jaw-dropping prices: In 2015, 4 sold for over $5 million. The median TIC sales price last year was $947,000.

Map of San Francisco Neighborhoods

Please call or email if you have any questions.

————————————————————————–

Some 2015 totals are projections based on MLS data available within the month of December. These analyses were performed in good faith with data derived from sources deemed reliable, but they may contain errors and are subject to revision. All numbers should be considered approximate.

© 2015-2016, Paragon Real Estate Group