The San Francisco market data for March 2015 is here.

The whole document is attached in case you are interested–it’s quite comprehensive and clearly shows the pricing and inventory trends. Below is a snapshot of the condo market in the last year.

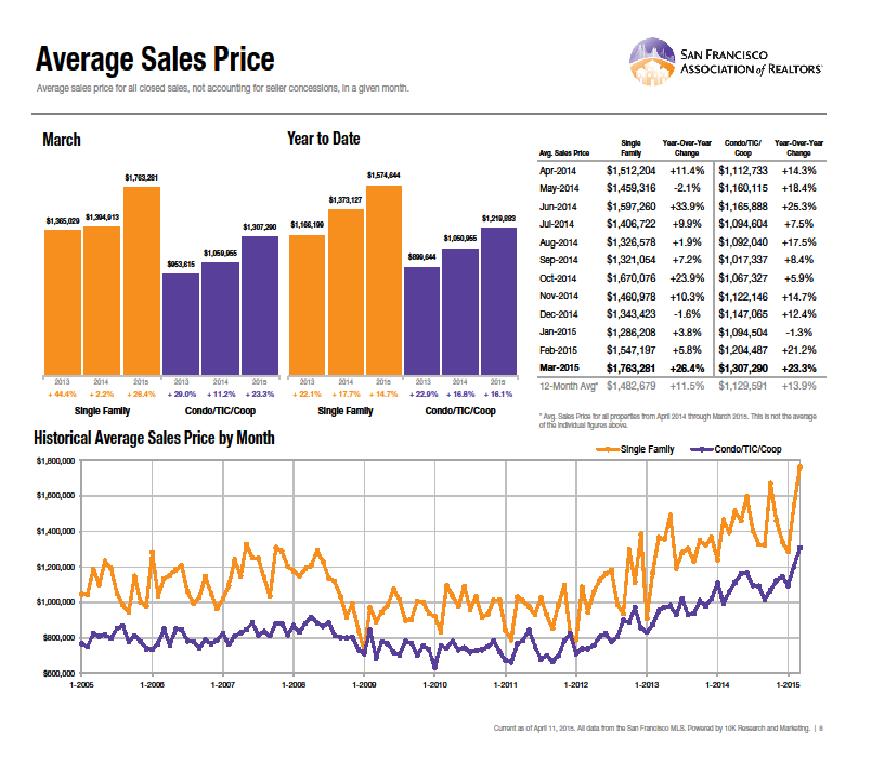

Condo prices are increasing at a rapid pace. There has been a 23.3% increase in the average price from March this year to March last year and 13.9% increase for the past 12 months.

What is a condo buyer to do in this market? What do these increases mean for your housing search? It depends on what we believe will happen in the near future. If we believe this is an artificial bubble and something will happen to deflate it quickly and significantly, then waiting is in order. But I don’t see any economic indicators to indicate that there will be less jobs and money in the Bay Area in the next year or two.

My recommendation is to determine what you can pay monthly for housing. Banks like to see no more than approx 40% of your gross income to be spent on housing. But aside from what a bank is willing to lend, each buyer must calculate what he/she can actually afford to spend on housing, which may be less than the 40% (+/-).

After determining this number (don’t forget to factor in approximately 1% of the purchase price for taxes and also about $500 for HOA dues), see what that translates to in terms of price.

Once you have this price, see what you can buy for this amount in SF this month, as next month it will cost more if the trend continues. Is what you can buy a property you wish to call home? If yes, the time to act is now.

To give an idea of what can be bought at varying price ranges:

Currently: $1,000,000 will buy a nice 1 BR, maybe with a deck and parking.

$1,150,000 will buy a smaller 2 BR (under 1000 sft).

$1,250,000-$1,400,000 will buy a larger 2 BR (more like 1200-1300 sft with parking), in the “hot spot areas” like Hayes Valley, Mission, Castro, Market, etc. Note: Typically, the higher the dues, the lower the price of the unit relative to a condo in a building with lower dues/ amenities.

Example of costs and income needed:

Price: $1,300,000

Downpayment: 20%

Loan: $1,040,000

Interest: 4%

Payment: $4965/ mo + HOA $500 + taxes $1200 = $6665/mo.

NOTE: all these numbers are approximate and for illustration only.

Approximate annual income needed: $200,000

Questions? Call me at 415 407 2595. Let’s talk about the market and how you can succeed in it. Thank you!