Author Archives: Pota Perimenis

San Francisco Luxury Condo, Co-op & TIC Market Trends Report

San Francisco Luxury Condo, Co-op & TIC

Market Trends Report

September 2017 Update

We usually use $1,850,000 as the price threshold for the luxury condo, co-op and TIC market in San Francisco: That approximately defines the top 10% of the market. The ultra-luxury segment starts at $3 million, which constitutes the top 2.5% of sales. Of course, what one gets in the different neighborhoods for the same price can vary dramatically: The city has an enormous range in locations, architectural styles, views and amenities.

All our Paragon reports can be found here

————————————————————

SF Condo, Co-op & TIC Sales over $5m

2017 YTD MLS Sales

Overview: Listing & Sales Activity

As of mid-month, 49 new luxury condo, co-op and TIC listings have come on the SF market since the beginning of September, so it looks like it may be a record-breaking month for new listing activity.

If you wish, you may skip our summary

and jump to additional

graphed analyses further below.

MARKET SUMMARY

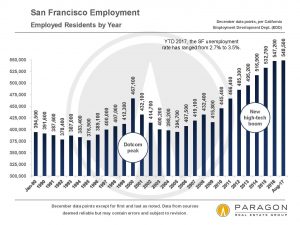

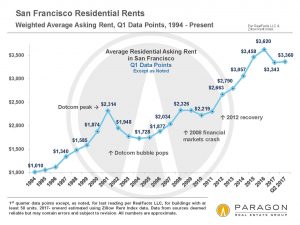

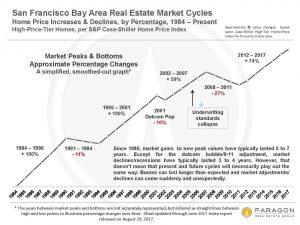

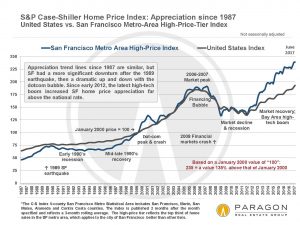

The luxury real estate market is impacted by a

number of factors: positively, by improvement in general economic

conditions and confidence, highly-paid employment and population growth, foreign buyers, and

especially, by the creation of new wealth in large quantities. All these

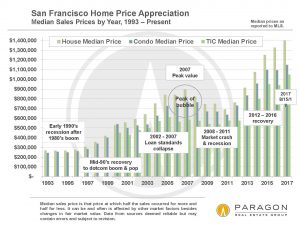

elements were dynamically present in the Bay Area from 2012 through mid-2015.

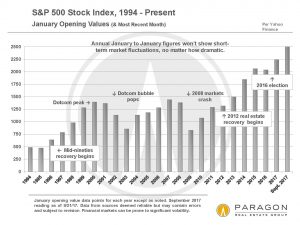

Then significant economic and political volatility put a damper on the market: Chinese stock market turmoil, the crash in oil prices, Brexit, the U.S. presidential election, as well as an apparent cooling in our high-tech boom, all injected uncertainty into financial markets and our local luxury real

estate market from late summer 2015 to late autumn 2016. Furthermore, Bay Area high-tech IPOs, which had created a

stupendous amount of new wealth since 2011, basically dried up during this period – and newly rich

or substantially enrichened buyers had played a big role in demand.

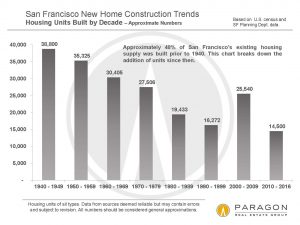

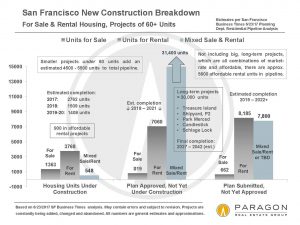

Generally speaking, most affected was the market for re-sale luxury condos, particularly in those

neighborhoods where big, new-construction projects are concentrated and dramatically increasing supply. It is hard to get

definitive data on new-project sales activity, but it is believed to have

softened as well with the overall jump in listings, all competing for the same buyers.

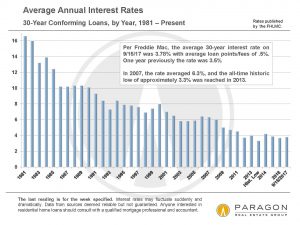

However, in June 2017, the SF luxury condo market suddenly hit a new high in sales volume. This accompanied feverish spring real estate markets around the Bay Area, though the more affordable segments were most frenzied, and house markets somewhat hotter than condo markets. Consumer confidence climbed, interest rates remained low and the stock market soared to new heights.

The biggest shift in the luxury condo market has been the dramatic year-over-year drop in sales reported to MLS in the greater South Beach-SoMa district, even as listing inventory there has hit new highs. As illustrated below, by virtually every market indicator – months supply of inventory, average days on market, and others – it is the softest luxury condo market in the city. This is the area where many big, new projects continue to come on market, and, to some degree, they are probably cannibalizing MLS sales as they aggressively compete with the resale market. This is also the district where the unfortunate issues at the Millennium Tower (slight sinking and tilting; multiple lawsuits) are being extensively reported upon. On the other hand, the high-end condos that do sell in this district still often achieve the highest dollar per square foot values in the city.

The Pacific Heights-Marina district and the Noe, Eureka (Castro) & Cole Valleys district have much stronger supply and demand statistics in their high-end condo markets, with the greater Russian & Nob Hills district a bit cooler.

————————————————————

Overview Dollar per Square Foot Analyses

———————————-

Most Expensive Luxury Condo, Co-op & TIC Buildings

in San Francisco, by Median Dollar per Square Foot

Each of these buildings had 7 to 23 sales during the period measured.

———————————-

San Francisco Luxury CONDO, CO-OP & TIC Market

by Top Neighborhoods & Districts

Each Realtor district delineated on the map above and the charts below contains a number of neighborhoods. For example, Realtor District 9 contains South Beach, SoMa, Mission Bay, Yerba Buena, Potrero Hill and the Mission (as far as luxury condo sales go). Sometimes the chart legends will mention different neighborhoods within the district, but it is always referencing the same District 9.

Top Luxury Condo Districts: Average Dollar per Square Foot Values

The highest luxury dollar per square foot values are achieved in the greater South Beach-SoMa district – almost all high-rises built within the last 20 years or so – and in the swath of much older, high-prestige neighborhoods, such as Pacific Heights and Russian Hill, running across the northern side of the city.

Top Luxury Condo Districts: Listing & Sales Volumes

The South Beach-SoMa district has by far the highest number of active luxury condo listings, and that does not include most of the new-project listings, which are typically not entered into MLS. So supply, or over-supply, is a major issue there in the market dynamic.

This next chart illustrates the abrupt plunge in sales over the past 15 months in South Beach-SoMa (tying neatly into when the Millennium problems started getting press coverage). The Pacific Heights-Marina district is now the top district for sales, followed by the Russian & Nob Hills area. Sales in the two relative “upstarts” in the luxury condo market – the Noe, Eureka and Cole Valleys district and the Hayes Valley-NoPa-Alama Square district – have been significantly growing in recent years.

Top Luxury Condo Districts: Months Supply of Inventory

South Beach-SoMa now has a very high months supply of inventory, while Pacific Heights-Marina and Noe, Eureka and Cole Valleys have very low MSI figures. Russian and Nob Hills have somewhat higher but still relatively low MSI figures in recent months. The lower the MSI, the stronger the demand as compared to the supply of listings available to purchase.

High MSI in South Beach-SoMa does not imply that luxury condos are not selling there, but it does mean that listings generally have to stand out as good values, i.e. priced correctly as well as prepared and marketed properly, to seize the attention of buyers confronted with so many options.

Top Luxury Condo Districts: Average days on Market

The same dynamic seen in months supply of inventory is replicated in the statistic average-days-on-market. Indeed, the dynamic is consistently illustrated, to a greater or lesser degree, in all the following charts.

Top Luxury Condo Districts: % of Sales Accepting Offers within 30 Days

The higher the percentage, the stronger the market.

Top Luxury Condo Districts: % of Sales Selling over List Price

The higher the percentage, the stronger the market.

Generally speaking, the higher the overbidding percentage, the more buyers are competing to win listings. However, it is also not unusual in recent years for lower priced areas to have higher overbidding percentages, and the Noe, Eureka and Cole Valleys district is distinctly less expensive than the other 3 districts illustrated on the chart below.

Top Luxury Condo Districts: Listings Taken Off Market without Selling

The higher the number, in relation to overall district

listing and sales numbers, the softer the market.

————————————————————

Ultra-Luxury Condo & Co-op Sales in San Francisco

The Top 2.5% of Sales, $3m+

As illustrated in the second chart below, sales at the highest end of the luxury condo and co-op market peaked in spring 2015, while the number of active MLS listings have continued to rapidly climb to peak this past June, so the supply and demand dynamics in this segment have changed considerably in the past 2+ years. This ties in with the financial market turmoil and plunge in local IPO activity that began in late summer 2015. At the same time, some of the recently built as well as upcoming condo projects are aggressively targeting this very expensive niche, adding further to supply.

This market segment targets a very small pool of very affluent buyers and it is not unusual that its statistics for months supply of inventory and average days on market to be appreciably above those in the general market. However, since spring 2015, both metrics have climbed much higher, to an average of 8.5 months of inventory and an average 55 days on market over the past year. This market has been clearly and significantly tilting to the advantage of buyers.

As seen earlier in the list of biggest sales and the chart showing the most expensive buildings, the ultra-luxury segment is totally dominated by neighborhoods such as Pacific Heights, Russian Hill, Nob Hill and South Beach-SoMa.

Please let us know if you have questions or we can be of assistance in any other way.

Our complete SF luxury real estate report (including luxury houses)

All Paragon Bay Area market reports

————————————————————

These analyses were made in good faith with data from sources deemed reliable, but may contain errors and are subject to revision. It is not our intent to convince you of a particular position, but to attempt to provide straightforward data and analysis, so you can make your own informed decisions. Median and average statistics are enormous generalities: There are hundreds of different markets in San Francisco and the Bay Area, each with its own unique dynamics. Median prices and average dollar per square foot values can be and often are affected by other factors besides changes in fair market value. Longer term trends are much more meaningful than short-term.

© 2017 Paragon Real Estate Group

| Paragon Real Estate Group www.paragon-re.com/ |

|

|