|

||||||||||||||

|

||||||||||||||

|

||||||||||||||

|

||||||||||||||

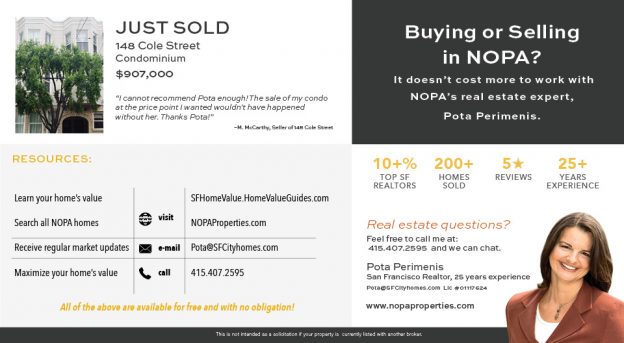

This month I sold 148 Cole Street, a lovely full floor condominium near Hayes Street for $907,000. We received multiple offers.

Typically, a property is vacant and staged for sale. This is fine if it’s possible. But not every seller is willing/able to move out of their home and stage before going on the market. This is fine too. Sellers living in their homes while they are marketed can still maximize their value–with the right marketing strategy and the right Realtor.

I have sold hundreds of homes in all markets and circumstances. I have never had a dissatisfied client. I put 100% of my energy, resources and 25 years of committed experience into every transaction. I limit the number of clients I work with to maintain the quality of my service. And no one knows the NOPA market and neighborhood better than I do. If you are thinking of selling I would love to help you too.

Give me a call and we can talk. 415-407-2595. There is no cost or obligation. Thank you!

Pota Perimenis

Local NOPA expert. Live. Love. NOPA.

“Pota has great insight, is a specialist in the NOPA area, and has great customer service skills. Her research and strategy skills resulted in a maximum return for our property.” B. Yokoyama, Satisfied NOPA seller.

San Francisco Median Sales Prices

by Neighborhood, 2016 YTD

Reflecting house & condo sales

as reported to San Francisco MLS 1/1/16 – 9/15/16

* Move your mouse over map to select neighborhood icons *

A Shift from Prestigious, Expensive, High-Tech and Hip

to Normal, Middle-Class, Working-People Affordable

October 2016 Paragon Market Report

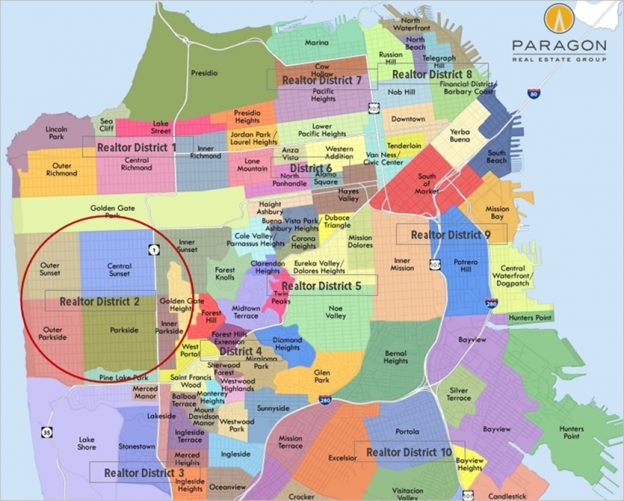

Since the market recovery began in 2012, various districts have taken the lead as the hottest markets in San Francisco: The affluent and prestigious Noe-Eureka-Cole Valleys district and Pacific Heights-Marina district led the recovery out of recession. Later South Beach/SoMa, Hayes Valley and, especially the Mission, went white hot as the high-tech boom surged (though, honestly, high appreciation rates became general throughout the city). In mid-2015, price appreciation in many the more expensive and fashionable districts started to slow down and plateau.

With the search for affordable homes, and houses in particular, becoming ever more challenging (or desperate), the greatest pressure of buyer demand moved to a large, lopsided curve of historically less expensive neighborhoods running along the western-most edge of the city from Outer Richmond south to Lake Merced, then east across the southern border with Daly City, and up through Bernal Heights and Bayview. Of these, we believe Realtor District 2, Sunset/Parkside, with its quiet streets and low crime rates; its closeness to the beach, GG Park and highways south to Silicon Valley; and its attractive, modest-sized houses built mostly in the 1930’s and 1940’s, is now the hottest, most competitive market in San Francisco.

|

||||||||||||||

|

||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

![]()

What costs how much and where in San Francisco?

I am pleased to offer a free home warranty to every buyer or seller that I work with. I recently got an email from a client who used her home warranty to get several repairs worth thousands of dollars in her home. She wrote me an email to let me know how useful the home warranty was for her and to remind me to remind my clients to use theirs! I love knowing I add value in a variety of ways to my clients, making their lives a little easier and saving them money in the process. For all my buyers and sellers–your home warranty is there in case you need it. I hope you don’t need to, but if you do, don’t forget to use it!

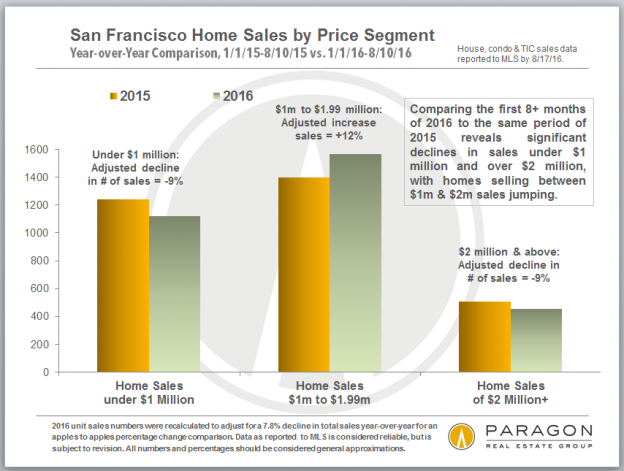

San Francisco Home Sales by Price Segment

In thinking about the market, it seems that lower-priced home sales (especially houses) were still quite hot and sales under $1 million were clearly decreasing in volume as prices rose in more affordable areas. And sales of higher priced homes were decreasing as that segment cooled off, which would suggest that sales between $1m and $2m would be increasing, i.e. sales volume was increasingly being concentrated in the middle of the market.

It appears that median prices have generally been plateauing, but that disguises other changes and varying conditions in the market.

When adjusting 2016 numbers to compensate for a year-over-year decline in unit sales of 7.8%. After doing so, one sees unit sales below $1m and above $2m both dropped by about 9%, while sales of homes in between jumped 12%.

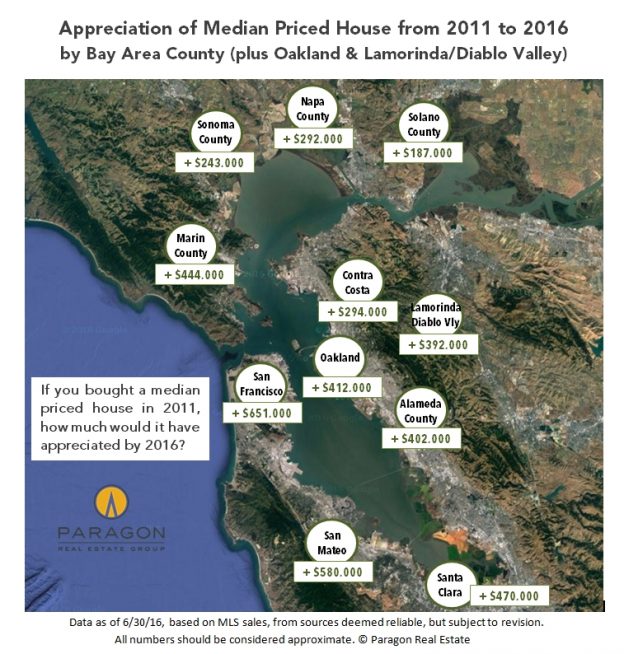

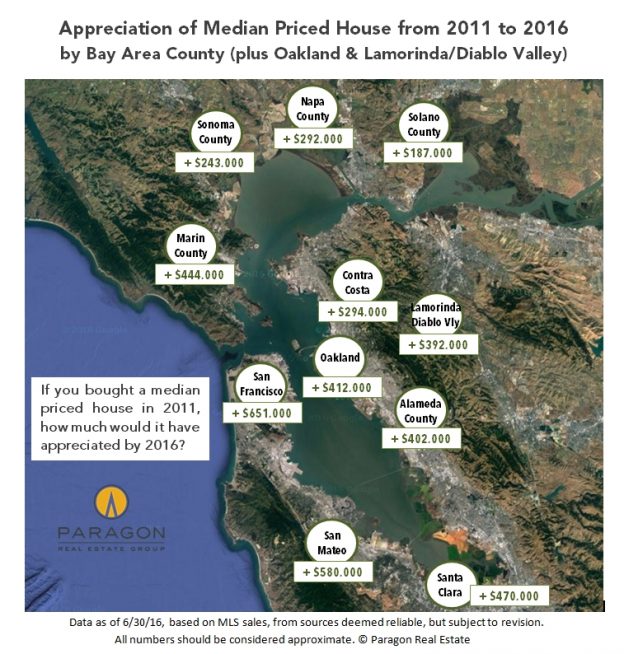

What Bay Area markets had the biggest bubble or crash?

Where are homes selling fastest for the most over asking price?

What county sells the most homes over $2 million?

Is most affordable? Most educated? Has the most Republicans?

Why do San Francisco, Oakland & Berkeley have rent control?

A San Francisco Bay Area Survey

including 20 custom charts and tables

August 2016

While waiting for the autumn market to begin, we thought we would step back and look at the Bay Area from a variety of angles. If you are tired of reading about real estate, there are some interesting demographic analyses at the bottom of this report.

|

|||||||||||||||

|

|||||||||||||||

Pota Perimenis is committed to providing an accessible website. If you have difficulty accessing content, have difficulty viewing a file on the website, or notice any accessibility problems, please contact us at (415) 407-2595 to specify the nature of the accessibility issue and any assistive technology you use. We strive to provide the content you need in the format you require.