Investing in Gold, Apple Stock or Real Estate? Plus October report

|

||||||||||||||||

|

||||||||||||||||

Investing in Gold, Apple Stock or Real Estate? Plus October report

|

||||||||||||||||

|

||||||||||||||||

Oil, Europe, China, the High-Tech Boom & San Francisco Bay Area Real Estate

From a talk given by CEO Robert Dadurka to Paragon agents on October 7, 2015

& San Francisco Bay Area Real Estate

to Paragon agents on October 7, 2015

For the past several years, oil has typically been selling for about $100 to $110 per barrel. In the past six months, it’s gone down to about $45 per barrel. That constitutes a crash in the oil market. Generally speaking, it’s a great thing for consumers at the gas pumps and a great thing in terms of the delivery and manufacture of goods. For us as American consumers it’s like a huge tax break, but for the countries that are dependent upon oil revenues it’s not a positive development. When the markets are looking at all this, they’re looking where the growth is in economies worldwide: Countries that are big oil producers aren’t doing so well.

Why does this matter? Well, it matters to Russia since a large proportion of Russia’s economic activity is through petrochemicals. It also matters to the Middle East, Canada, Mexico, Nigeria and Brazil. All of these economies will continue to have difficulties going forward – especially the Middle East. In the Middle East, 90% of Iran’s budget comes from oil revenues. With oil at $45 per barrel, they’re running a huge budget deficit and their economy is in dire straits. And low oil prices seem to be here to stay for quite some time, with some economists saying the price could drop as low as $25 or $35 per barrel because of oversupply. Other natural commodities, such as iron ore (Australia) and copper (Chile) have also been hit by huge drops in prices. The significant number of national economies with large vested interests in oil and other commodities in decline will almost certainly see increasing financial challenges in the near future. That has a global impact, which has implications for us as well.

Let’s talk about Europe. Europe did things very differently from what the United States did in 2008 and 2009. Back in 2008, we had the huge stimulus package, which was very controversial at the time. It did create very significant deficits, but it was the right thing to do considering the extremely dangerous financial circumstances. The United States spent about $2 to $3 trillion dollars on stimulus projects, and then there was also the Federal Reserve Bank with its strategy of quantitative easing (QE1, QE2, QE3): The Fed basically bought assets worth another $4.5 trillion. Those two efforts got the US economy jumpstarted and it is now actually doing quite well.

Instead of stimulus and QE, Europe instead took a path of austerity because of its concern regarding budget deficits. It was worried about things that it shouldn’t have worried about considering the circumstances prevailing at the time, so it didn’t go and flood its markets with capital. Consequently, its economies never really recovered as well or as quickly as ours. Certain markets are doing better than others: Germany and England are doing better, but Europe as a whole isn’t doing so well. Europe’s annual GDP growth was running about 1% to 1.5% and it looked like it might be going in the right direction, but over the past several quarters it started to go in the opposite direction, 1% or less. But more importantly, deflation is beginning to take hold in Europe, which can be extremely dangerous for the economy. Our inflation rate is running about 1.5% to 2%, but Europe’s was negative for the past quarter and it’s expected to be negative this quarter as well. However, Europe is finally waking up and taking aggressive measures of the kind the United States did in 2008 and 2009. They’re flooding the markets with capital, and they have their own type of QE program. We’ll probably see a lot of that type of activity now in Europe.

Another issue for Europe is the huge migration of immigrants from Syria, elsewhere in the Middle East, Afghanistan and Africa. Most are heading to Europe, looking for new homes. Where are they going to live? Who is going to feed them? What about jobs? Those matters are going to weigh on the governments where these immigrants land, and will raise some very significant political and economic issues for the EU.

Moving on from oil and Europe, let’s talk about the biggest issue here in the Bay Area, which is China, the 2nd largest economy in the world. China is the issue that economists and investors are looking at most carefully. After many years of torrid growth, China started going into a financial bubble, even as many aspects of its economy – construction and manufacturing in particular – began to slow. This past summer, China’s stock market dropped about 40% virtually overnight, after a massive surge in the previous year (a surge that had little basis in economic fundamentals). This sudden, dramatic drop hit consumer psychology hard, and many investors were wiped out. The Chinese stock market is 98% owned by individual, “mom and pop” Chinese investors. China doesn’t have the large financial institutions that the United States does, such as the hedge funds and large mutual funds that dominate the market here. Instead, its stock market is owned by ordinary people, who are even more inexperienced financially than ordinary people here. They began to panic and sell their stocks, and this created a huge, plunging, downward spiral.

In response to this, China did two things: 1) it ceased the trading of all small- and mid-cap stocks (about 60% of their market), and 2) it began buying assets in great quantities. While the Chinese economy has stabilized as a result, it’s created somewhat of a false stabilization instead of letting the market go down and hit bottom and then be rebuilt. So there’s more to play out with the Chinese market — it doesn’t have the systems or institutions that we have in the United States, and the stock market collapse has changed the way people perceive China. We’re seeing a significant flight of capital from Asian consumers — the United States being a beneficiary of that. San Francisco and other US markets that the Chinese know are probably going to see more of that capital coming in the short term.

The other part of the bubble we’re seeing in China is in its residential and commercial real estate markets, as this video from the Financial Times illustrates. (You’ll want to click on “Skip Ad” quickly.)

Concerns Grow over China’s Property Market

What does all this mean to the United States? Of the S&P 500, only 10% of those companies get a significant portion of their revenue from China. So the actual impact here may not be that great in terms of fiscal impact or jobs, but there’s a psychological impact that could occur and we’ll see where that goes.

Now to the good news!

In the United States, we’re doing really, really well and headed in the right direction. Our inflation is very low — we’re running around 1.5% to 2%. Our GDP is on the upswing — this year we’re looking at about 2.5% GDP growth for the year following a slow (negative) first quarter of 2015 and a very healthy fourth quarter (projected around 3%). Some economists are saying we could see as high as 3.5% GDP growth next year. Unemployment: we’re at 5.1% – in most markets over the past couple decades that would be considered full employment. As mentioned earlier, low oil prices are a bonus to us and will add some grease to our engine. Additionally, interest rates remain very low. The United States is experiencing very strong household formation — we have 1.5 million new households and only 1.2 million new homes being built, so supply is not meeting demand. Real estate will be a shining part of our economy going forward. 65 million households in the US are making $100,000 per year or more — what’s even more interesting is that two thirds of those individuals are Generation X, Generation Y and Millennial. So there is now a transfer of wealth from Baby Boomers to these younger populations. Lastly, nine of the top 10 companies in the world are US based. We have Apple, we have Google — virtually all of the biggest, most successful and dynamic companies are here.

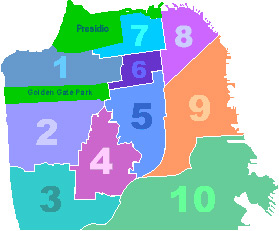

The San Francisco Bay Area is at the center of much of the United States’ growth. Two thirds of the jobs now in San Francisco are tech related. That’s a huge change from 10 or 20 years ago. We used to have textiles, Levi and Gap. We used to have Chevron, Bank of America and PacTel headquartered here. Now, tech is the big driver of our economy in San Francisco. It’s projected that the Bay Area’s population will grow by 30% by the year 2040. That’s about another million people — and where they’re going to live is a really good question. We’re seeing a lot of high-rise development in San Francisco and a lot of infill development in some other markets. The venture capital put into the United States’ economy in 2015 is estimated at $45 Billion. Of that $45 Billion, $26 Billion is in California, and 46% of that is specifically here in San Francisco. Why is all of this happening here? It’s the culture of innovation:

Silicon Valley’s Innovation Secret

When we’re talking about technology, there’s a misnomer that we’re just talking about Silicon Valley. But Silicon Valley is really the entire Bay Area now. High-tech is spreading throughout the city and around the bay. For example, Uber just bought the Sears building in downtown Oakland; PeopleSoft and Oracle are in Contra Costa. If GDP growth was measured just in the Bay Area counties, it would probably be 5.5% to 6% per year, a cracking fast pace. Though there will continue to be challenges, all this is certainly going to benefit our economy and our real estate market.

According to John Rahaim, Planning Director for the City and County of San Francisco, there are currently 8,130 units under construction, with an additional 1,850 units (195 projects) that have been permitted, and another 28,900 (110 projects) which are Entitled. On top of that, John reported, there are 15,670 units (580 projects) that are currently under review.

Recently Built & Under Construction

Mouse over map to reveal project icons and details

New Condo Developments in San Francisco...There are hundreds of existing condo buildings in San Francisco that have moved beyond the new development phase, and in which resale condos are commonly available. Please contact me with any questions. I stay informed on both the new and resale condo market.

|

||||||||||||||||

|

||||||||||||||||

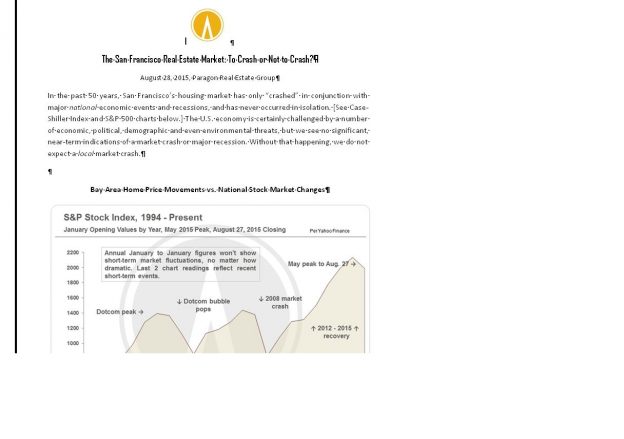

The San Francisco Real Estate Market: To Crash or Not to Crash?

August 28, 2015, Paragon Real Estate Group

In the past 50 years, San Francisco’s housing market has only “crashed” in conjunction with major national economic events and recessions, and has never occurred in isolation. [See Case-Shiller Index and S&P 500 charts below.] The U.S. economy is certainly challenged by a number of economic, political, demographic and even environmental threats, but we see no significant, near-term indications of a market crash or major recession. Without that happening, we do not expect a local market crash.

read full article

So often I hear from both buyers and sellers: “I found this property on-line. Can you tell me more about it?” Many times it will be an old listing, already sold, from a website that has not been updated.

If you have been in this situation and want real-time, accurate access to the SAME MLS that we Realtors use so that you can see ALL the properties on the market, I can help.

Click here for this free service. Type in my name, Pota Perimenis. That’s all there is to it. You can now search for all properties in San Francisco, track them, save favorites, and get automated alerts. This is a FREE service I provide with NO obligation. Enjoy!

Pota Perimenis is committed to providing an accessible website. If you have difficulty accessing content, have difficulty viewing a file on the website, or notice any accessibility problems, please contact us at (415) 407-2595 to specify the nature of the accessibility issue and any assistive technology you use. We strive to provide the content you need in the format you require.